Audit

Scotland has published NHS

financial performance 2011/12, an overview of the financial

performance of the NHS in Scotland in the last financial year. It shows a

picture of increasing financial pressure on health boards as the real term cuts

bite.

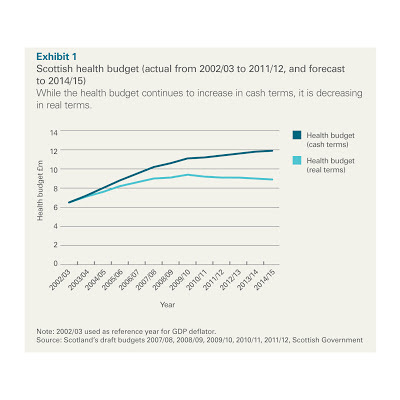

Although

the overall health budget has continued to increase in cash terms, it has been

decreasing in real terms since 2009/10 and is projected to decrease further in

real terms for the next three years. The

NHS continues to face significant pressures that will make it difficult to

reduce costs while maintaining high-quality services. Demand for services

continues to grow, particularly due to an ageing population; it is becoming

more difficult to identify recurring savings as early opportunities have

already been targeted. Building maintenance (£1bn backlog) and rising drug

costs (+3.2%) are highlighted in the report. Spending on heating and lighting

increased by 5.8 per cent on the previous year.

Three of the 14 territorial boards (Fife, Forth

Valley and Orkney) would not have broken even without additional financial

support from the government. As

the three boards are using £6.2 million of capital to repay their revenue

brokerage, these funds will not be available to the overall NHS capital budget.

There is also a risk that the investment needed to maintain and develop the

clinical estate, equipment and ICT will be unaffordable.

Nine

territorial boards reported an underlying recurring deficit in 2011/12. Around

20 per cent of savings (£67 million) were non-recurring in 2011/12. This means

that boards need to make further savings of £67 million immediately in 2012/13

just to be level with the 2011/12 position. These £67 million savings are

included in the 2012/13 savings target of £272 million. Each year, it becomes

more difficult for boards to find recurring savings.

Eight

boards have categorised at least a quarter of their savings plans as high risk,

with NHS Lothian stating that two-thirds of its savings plans are high risk.

Overall, 20 per cent of the savings target is classified as high risk, raising

concern about the achievability of the savings plans and boards’ ability to

break even in 2012/13.

The

NHS in Scotland employed 131,172 people (135,823 at 30 September 2009). Further

reductions in staff numbers are expected reducing to 130,370 by March 2013.

This represents a cumulative reduction of four per cent since 30 September

2009. While there have been increases in medical and dental staff over this

period, nursing and midwifery numbers are forecast to reduce by four per cent.

The largest decrease will be in administrative staff (8.1 per cent).

In

2011/12, total spending on PFI charges was £184.5 million (£154.1 million in

2010/11). This was due primarily to increases in charges of £15.7 million in

NHS Forth Valley and £8.1 million at NHS Fife, as a result of the completion of

the new PFI projects at the Forth Valley Royal Hospital in Larbert and Victoria

Hospital in Kirkcaldy. PFI charges are a significant financial commitment for

boards.

Auditor

General for Scotland, Caroline

Gardner, said:

“The

NHS in Scotland continues to manage its finances within its total budget, and

has achieved this for the fourth year in a row. The annual accounts show a

picture of good financial performance, but this doesn’t reflect the pressure

boards faced in achieving this. Money was moved between boards, several relied

on non-recurring savings, and some needed extra help from the Scottish

Government to break even in 2011/12. The requirement for boards to break even

each year encourages a short-term view, and the NHS needs to increase its focus

on longer-term financial planning.”

i love you fozia

ReplyDelete